Solo Stakers aren’t going away

Authors: @GLCstaked / @alijprofWhat is a Solo Staker: is deserving of its own post; see this article by Nixo from Ethstaker.

Independent operators who run validators with their own capital. They can run their own infrastructure (e.g. stake from home) or use cloud (VPS) for hosting but are in complete control of the setup, maintenance and keys.

Data Source: GitHub/Stake-Cat: Solo Stakers

StakeCat maintains a repository intended to identify addresses under the control of solo stakers. The data used in this article is based on this repository, using Version 1 with beacon data up to the latest snapshot: `Dencun network upgrade 2024-03-13`. For detailed information on methodology: See README.md

Goal: Solo stakers are highly important for network security. The more solo stakers, the more decentralized and robust the network. Ethereum is by far the most decentralized consensus layer by this metric. In this article we explore some findings on the solo staking landscape from the latest update from the repository above.

We found that the number of solo stakers at the Dencun hard fork was between 10,053 and 18,115, representing between 9.78% and 19.46% of the network. We created two lists, a floor (high-confidence list) and a ceiling (maximum possible). Since the Beacon Chain's launch, the number of solo stakers has been increasing while the share of the network that they represent has been relatively steady since mid 2021, however has been increasing for over a year. Solo stakers have a lower rate of exit in comparison to entities, confirming the hypothesis that they're 'stickier' than delegated stake.

External rewards are increasingly beginning to play a part in solo staking - 41.74% of new solo stakers at the Dencun hard fork had Eigenpods as their withdrawal addresses and airdrops from token launches have begun to target solo stakers as a high-value recipient for allocations. Updates to solo staking lists and projects that allow stakers to self-identify will provide better resources to facilitate targeting this group and further incentivizing solo staking.

How many Solo Stakers

Solo Staker Count:

Using the data from the repository identifying solo staker owned accounts, we try to get a total count of the number of solo stakers on the network over time, excluding validators under management or exited validators. We see at least 10,053 unique solo stakers on the Network, and potentially up to 18,115.

Fig 1: Solo Staker Bounds *Data to 13th March only

It's extremely challenging to get a true count of solo stakers. Unlike entities whose behavior is easier to track with disclosures and self-identification, the identification of solo stakers is much more difficult. The real number falls somewhere in-between, the graph above (for full detail on methodology see Solo-Stakers/README).

Upper bound: ‘A’ is a ceiling on the total number of solo stakers; it is likely to contain some unidentified entities, but all solo stakers should be here.

Lower bound: ‘B’ is a floor on the total number of solo stakers, by looking for high confidence solo staker owned accounts with a rich history of smart contract/token interactions indicative of normal Ethereum users. (any accounts on B will also be in A).

Rocket Pool: It's evident that Rocket Pool node operators represent a significant share of the solo staking landscape, 25% of solo stakers (Solo-Stakers-B). Both sets include ‘Rocket Pool Solo Stakers’ to get the full picture and are included as solo stakers for the purpose of this article in most data sets, unless specified otherwise.

We assume ‘one account = one individual’ and make no attempt to link accounts across individuals. However, we believe this is not a significant factor and discuss in the section “Staking Distribution in Solo Stakers”. The “Coinbase problem” expanded upon in detail in this article (based on previous Repository version 09-2023), results from Coinbase being the largest culprit of single-use staking deposit addresses, and we found that 135k+ unique deposit addresses are Coinbase-owned.

Are Solo Stakers increasing?

Rate of new Solo Stakers

We look for the number of new solo stakers joining the network to find the rate of growth. Achieved by identifying solo staker addresses and counting the new unique addresses per month that fall into the solo staker category.

Fig 2: Rate of New Solo Stakers

After deposits stabilized from Genesis, the rate is positive and shows a consistent inflow of new solo stakers over time.

From Genesis: Ethereum’s shift to Proof of Stake was years in the making with development before 2018. The Genesis of the Beacon Chain was not until 2020-12-01, more than 5 years after the launch of the PoW chain. Despite the inability to withdraw, a large grassroots ‘OG’ community was eager to join as the first stakers, with many joining the pre-genesis stage. With APR responsive to the amount staked, yield was initially at 18% (down to 10% just two months later) and many stakers joined in the months immediately following the launch.

Fig 3: Rate of new Solo Stakers since Genesis

Solo Staker Share of Network

Total Validators owned by Solo Stakers

We look at total active validators on the network over time and find which are under control of solo stakers, using `Solo-Staker-A` and `B` including identified Rocket Pool solo stakers. This shows what percentage of the network stake is owned by solo stakers over time. The same with solo staker bounds `Solo-Staker-B` accounts for high confidence solo staker owned addresses, with `Solo-Staker-A` being a cap on potential limits.

Fig 4: Solo Staker Share of Total Validators

Early days we see solo staker share at peak when the beacon chain just launched much of the network run by these early "testers” keen to be first in. Solo stakers begin to lose share to entities that can offer liquidity and yield, these actors taking more time to establish their operations and assessing demand.

At the Merge we see 7.5% of validators run by solo stakers as a base estimate, this is close to the low point in solo staker share of the network.

NOTE: this is around what Rated network arrived at the time (recently increasing their estimation to 7.2% index height 500k), who look to identify solo stakers with different methodology by looking at validator performance whereas we look at deposit addresses as a base.

Approaching the Shapella upgrade (withdrawals enabled) we start to see this pick up, as now stakers can unstake freely and illiquidity risk is reduced, ending with solo stakers in control of somewhere between 9.78% and 19.46% active validators around March 2024.

Staking distribution in Solo Stakers

We looked at the staking distribution across solo stakers by how many validators are run per account.

Fig 5: Solo Staker A includes B, rocketpool is a separate count from solo stakers.

Solo Stakers:

Single: Almost 50% only have one validator. 32 ETH, prices out many market participants and it's very possible that most solo stakers only have one validator each. This could be obfuscated by some set of privacy focused solo stakers using temporary deposit addresses to hide their activity..

Multiple: Between 28.5-35.6% (A and B) have between 2-10 validators, which may imply that many solo stakers use the same deposit address (opposite behavior of temporary deposit addresses). This pattern supports the reliability of the general analysis and methodology.

Large stakers: There are numerous larger solo stakers in Ethereum from its early days before the transition to proof of stake. The ‘OG Ethereum community’ likely already has a lot of ETH and therefore a large validator count. These are individuals that may have similar TVL as entities, but that does not necessarily mean they are entities.

Delta between A & B: We would expect unidentified professional entities in A to show a large difference in the extremes (many validators or only one). However, we see similar data between A + B, so we believe the profile of unidentified entities in `Solo-Staker-A` is not of much concern.

Rocket Pool: Stands out as more evenly distributed. This can be explained how Rocket Pool works, as a minipool is 16ETH (+RPL), and now with LEBs (Lower ETH bonded pools - 8ETH) opens solo staking to more participants, but also allows solo stakers to run more validators than they would otherwise.

Entities: (not displayed in chart) We evaluated only positively identified entities from externally owned accounts (“EOAs”), but we found what we would expect, with virtually 0% in the 2-10 range, the rest with 50 validators and above. Entities would either hold large validators under one account or use temporary deposit addresses such as Coinbase, where 99% of the distribution fell (see Coinbase problem).

We expect that if we look at contract depositors, the weight will be heavily skewed to 100+ validators.

Validator Bond – cost of entry

The assumption would be that solo stakers diminish over time, as the cost of entry (32 ETH) becomes increasingly restrictive and the staker profile changes from hobbyist to more institutional actors.

Fig 6: Active validators – addresses with 32+ ETH

‘Active validators’ continue to increase over time and ‘Price of a Validator' is simply the price of ETH x32 but demonstrates an increasing economic barrier to entry, a full validator is now a $100k+ asset. This puts into perspective that a steady or slight increase in new solo stakers is impressive, as individuals still look to acquire this bond.

Addresses with 32+ ETH: we looked at normal Ethereum addresses (EOA) with a balance of over 32 ETH, the staking requirement for a validator. Notably there are still 120,000 addresses with over 32 ETH, addresses that could become solo stakers, as this is idle ETH not in LSDs or in smart contracts.

Solo Staker Behavior

Withdrawals

Based on our data (excluding entities depositing from contracts), we compared total withdrawals by solo stakers against entities, by looking for which validators have exited (full withdrawal) the beacon chain since Genesis.

Fig 7: Total withdrawals comparison

We can see a clear difference in `exited` validators. Solo stakers are more fixed with most continuing to stake, whereas Entity stake shows increased churn (more susceptible to rotation).

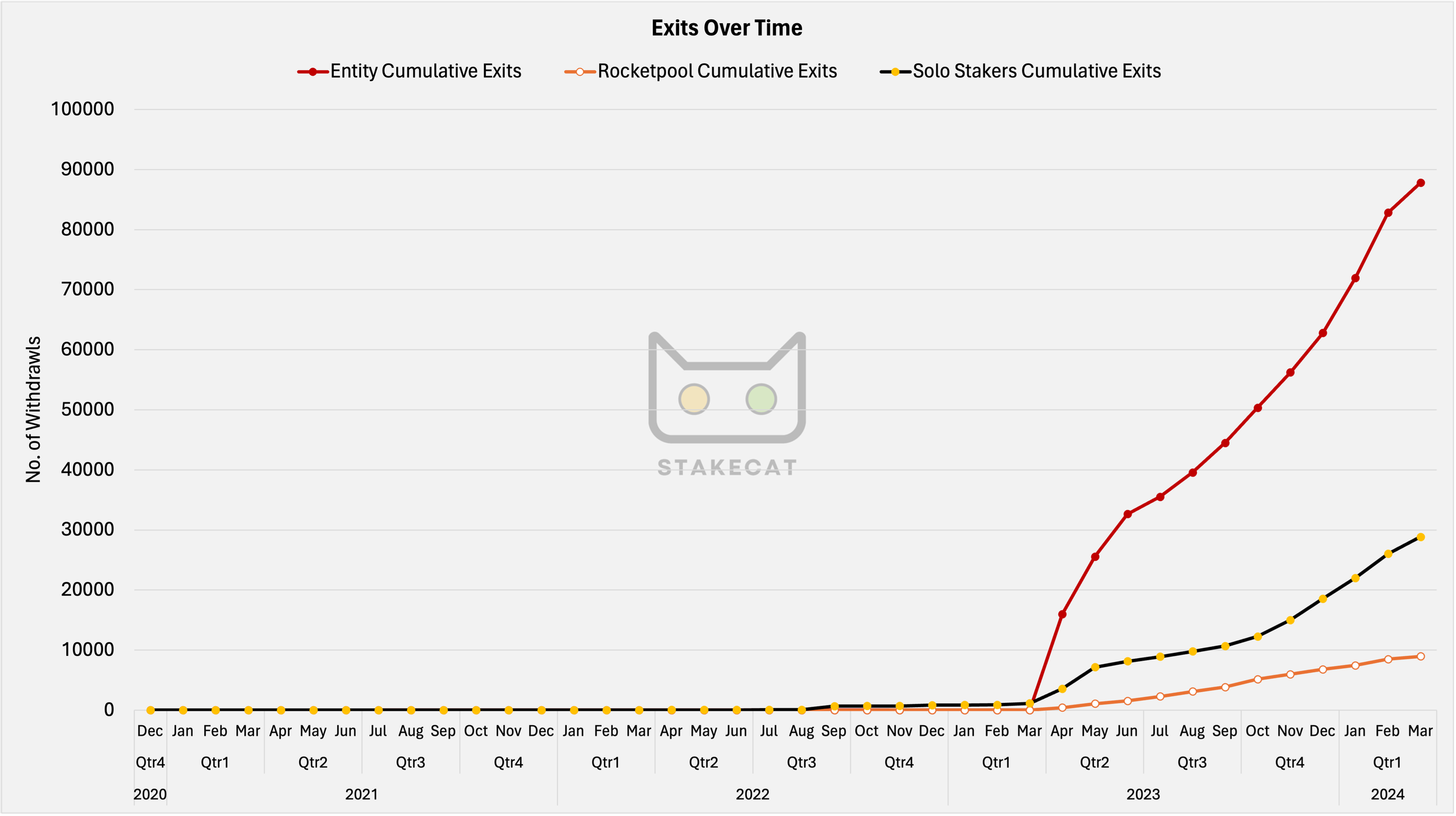

FIG 8: Total Exits over time.

Withdrawals were only enabled on the Shapella network upgrade on 12 April 2023. Until then, stakers were locked up for 2.3 years with no ability to withdraw ETH. Many expected that the majority of locked stakers would withdraw once enabled but this does not seem to be the case and especially from the solo staker cohort.

FIG 9: Total exits over time *Log version of FIG 8

Before withdrawals: A validator could be Exited at any time since Genesis, but withdrawals were only enabled in the Shapella upgrade. Until then, a validator could be stopped but would remain locked in the beacon chain. We see virtually no exits from Entities until withdrawals were enabled, whereas solo stakers had Exited gradually leading up to the upgrade.

Entities: exit to rotate capital or adjust to new business strategies; The commitment to long-term contracts suggests planned and strategic exits aligned with business cycles, which is why we see no meaningful exits until Shapella upgrade.

NOTE: the premature entity exits, might be misidentified solo stakers who show up in Coinbase `Entity` set, due to behavior pattern that would have identified them as Coinbase (See Readme Methodology).

Solo stakers: may exit for personal reasons (such as moving house), which is why we see gradual exits from solo stakers up to Shapella, this gradual trend reflects a less strategic, more individual-based decision-making process in exiting.

The large spike in Q3-2022 could point to a large solo staker, as no entity behavior demonstrates meaningful exits until shapella.

Other Behavior

Fig 10: Total offline, slashed, exiting

Uptime: Active offline

This is only one data point at the time we exported data from the beacon chain, however this demonstrates what we would expect. Solo stakers are less concerned with 100% uptime, many of whom stake from home. At the time of the snapshot, only Entity validators were in the exit queue.

NOTE: Entity does not include smart contract entities (e.g. Lido) but we expect to see a similar pattern for contract depositors.

Slashing: we look at the total validators that have been `slashed` as a percentage of the total. Solo stakers are responsible for the majority, but entities are not immune to this critical error, which could be considered worse when managing others’ money.

Explanations for solo staker trends

Merge and withdrawals

The Merge: when Ethereum fully transitioned to proof of stake, all stakers before this upgrade had already committed to bootstrapping the proof of stake chain. These early stakers took on significant risk before proof of stake was proven on Ethereum.

Shapella: all stakers before this upgrade had committed to lock ETH and secure the network before withdrawals were possible and for an unknown period, sacrificing liquidity to provide security to Ethereum.

Following the success of these major milestones on Ethereum, solo stakers who were previously sidelined now had the confidence to begin solo staking. We see that solo stakers who staked before these upgrades, are very dedicated and aligned with Ethereum the majority are still active validators, over 80% of pre-genesis stakers are still staking.

FIG 11: percentage of Solo Staker validators still active at various milestones.

Solo Stakers withdraw much less

We see that solo stakers exit much less compared to other groups. This can be attributed to several factors. First, solo stakers typically exhibit "lazy capital," meaning they are not active investors constantly chasing yields through DeFi applications. Instead, they prefer to let their ETH sit passively. Additionally, many solo stakers are driven by a deep appreciation for the technology itself, viewing their involvement as a badge of honor by helping to decentralize Ethereum. Finally, having already invested considerable effort and resources into setting up their nodes, these stakers are motivated to maximize their initial efforts by continuously earning yield, rather than cashing out prematurely.

EigenLayer

EigenLayer extends ETH security to other applications through a new primitive called ‘Restaking’ which opens additional yield to “vanilla” staking and changing the staking landscape noticeably and into the future, becoming an important consideration for boosting yield to stay competitive.

Deposits opened on 23 June 2023, with no cap for ‘Native Restaking’, essentially a full validator but with withdrawals pointed to a custom user generated ‘eigenpod’ contract. This allows solo stakers to use that staked ETH to extend security to other applications though Actively Validated Services (AVS) for additional yield.

Fig 12: Total Active - Lido TVL

Eigenlayer created a surge in demand for new validators in two fronts:

Indirectly: demand for more LSTs requires more validators (ETH staked) to back them, and much of this new LST demand found its way to EigenLayer seen as the lucrative farm opportunity.

Directly: Native Restakers, ETH staked to the beacon chain directly with withdrawal credentials pointed to eigenpods to opt into Restaking, either from solo stakers or Liquid Restaking Token (LRT) projects, native restaking to back their LRT.

EigenLayer TVL is 66% LSTs and 34% Native, By the end of March 9.89% of all Ethereum validators are Native Restaking (96,834/979,013 validators). Another visible effect is rotation among the Liquid Staking Token (‘LST’) players; at its peak, Lido had accumulated nearly 33% of total stake dropping to 28.76% end of April, with most of this TVL moving to new Liquid Restaking protocols (LRTs) EtherFi, Renzo & Puffer. But how did this affect solo stakers?

EigenLayer Solo Stakers – EigenPod Flippening

Amount of new solo staker validators restaking

Our `metadata` tags identify which withdrawal addresses are Eigenpods, so we looked at the number of new solo staker validators joining the network and what portion of those new validators have withdrawal credentials pointed to EigenPods.

Fig 13: Eigenpod share of new solo staker validators

A larger and growing portion of new solo staker validators are Eigenpods (Native Restaked ETH) on Eigenlayer, from our data (last full month) 41.74% of new solo staker validators are Restaking. EigenLayer has attracted new solo stakers to the network, possibly looking for additional yield. The potential rewards from AVSs are certainly a factor that these solo stakers are considering.

Another likely major factor was speculation on the $EIGEN airdrop, which has since been released and rewarded ‘Native Restakers’ with heavier weight than LST restakers.

Additional note: We don’t have the data yet, but since the launch of $EIGEN, it will be interesting to review if this changes, now that the speculative airdrop farm has “concluded” (in quotes as points and seasons are ongoing), whether these solo stakers are long term solo stakers that will use Eigenlayer to boost base staking yield with AVS’ or are simply here for the airdrop remains to be seen.

Airdrops to Solo Stakers

Until now, Airdrops have mostly been directed to normal network users. “Airdrop Farming” has become a market sector itself, where the best way to be included was to become a frequent user of protocols that have speculation of some future token and to hit an ever-changing variety of eligibility criteria.

StarkNet is the first high profile airdrop to include solo stakers in token distribution and brought attention to this concept. The first project to do this, DIVA staking included solo stakers in governance token allocation.

Inclusion of solo stakers can be a user acquisition strategy to target the type of user capable of supporting node operations, this makes sense for projects that value decentralized node operators.

In the increasing game of countering sybils in airdrops, inclusion of solo stakers can itself introduce some sybil resistance as it is hard to game with the capital requirements, explored more here.

StakeCat: we are keeping track of airdrops that include Solo Stakers

We don’t see this trend stopping, as more projects will include solo staking as criteria for their airdrops to give back to the Ethereum community or attracting a user base which is tech-savvy and values-aligned. We believe this is now a motivating factor in the decision to solo stake vs stake with Entities (hold LSTs).

Closing remarks

Key takeaways:

There is a consistent inflow of new solo stakers over time.

Solo staker share of the network is climbing since 2022.

Solo stakers are longer term focused, unmoving, preferring to collect the staking yield and have exposure to the underlying asset (bond) while possibly playing the block reward lottery.

We are seeing increasing incentives targeted at solo stakers, which is likely influencing new solo stakers to join instead of delegating.

EigenLayer changes the game, and solo stakers will need to consider restaking/ running AVS to remain competitive.

Solo stakers aren’t going away and will continue to be an integral part of Ethereum network bolstering decentralization.

Afterward: the emergence of DVT

by @knightsemplarSolo staker expansion

They have been called “the backbone of Ethereum” as they provide the much-needed decentralization component to Ethereum's node operators. But with an increasing financial burden, it’s possible that solo stakers may decline as ETH’s price rises. So, what’s being done to lower the price of entry?

Distributed Validator Technology (DVT)

DVT has been in the works for a couple of years now and is gaining a lot of traction. DVT enables a new kind of validator, one that runs across multiple machines and clients simultaneously but behaves like a single validator to the network. StakeCat, for example, are running a 6/9 validator using Obol’s DVT. This is split into 9 operators, lowering the cost of deposit to 3.56ETH per operator while boosting decentralization by having nodes all over the world. Furthermore, we are using multiple combinations of consensus and execution clients in our nodes. All the while competing with professional node operators despite running this on stake at home machines. There have been ups and downs but we have continued to attest due to the 6/9 fault tolerance. Three operators could be offline, and we will continue to attest.

Recently Lido has expanded its node operator set by introducing Simple DVT pushing the node operator set to 109 node operators, with many more cohorts utilizing both Obol and SSVs DVT. StakeCat are proud participants.

Lowering the bond

Lido is also introducing a Community Staking Module (CSM) that will enable bonded entry to node operations while utilizing DVT.

Puffer Finance, a project focusing on Liquid Restaking Tokens (LRTs) is allowing entry to their node operations by introducing a permissionless bonded market for validators with a much lower barrier to entry (1ETH per validator) than the current market rate.

EtherFi is running an “operation Solo Staker: Enabling ANYONE to run nodes" again utilizing DVT.

As these efforts pick up, we can expect to see more solo staker adoption and further strengthening of the Ethereum blockchain through decentralization of the node operator set.

Our commitment

At StakeCat, our dedication to Ethereum's decentralization is evident in all our actions. We champion decentralization and back DVT to bolster the network's security and robustness. As solo stakers, we uphold the principles of solo staking by operating our own hardware in our own data center and contributing individually to the network's strength.

We aim to continue this journey by exploring and adopting cutting-edge technologies that enhance network security and resilience, ensuring a robust and decentralized Ethereum ecosystem.